Take Action on a Time-Limited Student Loan Forgiveness Opportunity

View a helpful webinar about this program from the Massachusetts Attorney General:

You may be able to receive loan forgiveness or get closer to forgiveness through a “payment count adjustment” that the U.S. Dept. of Education is conducting for Income-Driven Repayment (IDR) and Public Service Loan Forgiveness (PSLF) — even if you have never previously enrolled in these programs.

IDR plans forgive any remaining loan balance after 120-300 qualifying monthly payments. Your IDR forgiveness timeline primarily depends on your original loan balance, and whether you took out federal loans to attend graduate school.

The PSLF Program forgives the remaining balance on your Direct Loans after you’ve made 120 monthly payments under a qualifying repayment plan, while working at least 30 hours per week for the government or certain types of nonprofits.

Through the payment count adjustment, you can get credit for past repayment periods and certain forbearance and deferment periods that would not otherwise qualify toward forgiveness.

To benefit, you must apply to consolidate your privately owned FFEL Program Loans into the Direct Loan Program by June 30, 2024. (Update: deadline has been extended to June 30, 2024.)

Even if your loans have not yet been in repayment long enough to be forgiven, you can still get credit toward loan forgiveness through this adjustment. You can then continue earning credit toward forgiveness by enrolling in an IDR plan, like the new more affordable SAVE plan.

How Can the Payment Count Adjustment Help Me Get Loan Forgiveness Faster?

Through the payment count adjustment, you can receive credit toward Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) forgiveness for past repayment periods that wouldn’t normally qualify. For example, you can get credit for:

- Payments made on ineligible federal loan types.

- Payments made on federal loans that you consolidated.

- Past repayment periods, regardless of whether you made the payment on time, for the full amount due, or under a qualifying repayment plan.

- Forbearance periods of 12 or more consecutive months or 36 or more cumulative months.

Under IDR plans, most borrowers can receive forgiveness in 20 years if they have only undergraduate school debt and 25 years if they have graduate school debt or Parent PLUS Loans. However, if your original federal loan balance was $21,000 or less, the SAVE plan offers forgiveness after 10-19 years depending on your original balance.

PSLF offers forgiveness after 10 years of qualifying employment and payments.

Learn more about the payment count adjustment on the U.S. Dept. of Education’s website.

Step 1: Consolidate Your Privately Owned Federal Loans into the Direct Loan Program.

To benefit from the payment count adjustment, you must consolidate any non-Direct Loans (e.g., FFEL, HEAL, and Perkins Loans) by June 30 2024.

Consolidate on the U.S. Dept. of Education’s website.

Step 2: Even If Some of Your Loans are Direct Loans, Consider Including Them in Your Consolidation to Speed Up Forgiveness.

Even if some of your loans are already Direct Loans, consider whether including them in your consolidation will speed up forgiveness. You may be able to maximize forgiveness by consolidating your older loans with your more recent loans by June 30.

The payment count adjustment will credit your new consolidation loan with the largest number of qualifying months among the loans that were consolidated.

For example:

- If you consolidate a loan that’s been in repayment for 50 months with a loan that’s been in repayment for 100 months, the resulting Consolidation Loan will receive 100 months toward Income-Driven Repayment forgiveness.

- If you worked at least 30 hours per week for the government or a qualifying nonprofit employer between your undergraduate and graduate studies, consolidating all your loans together will speed up forgiveness on your graduate school loans through PSLF.

Step 3: Enroll in an Income-Driven Repayment (IDR) Plan.

To keep earning credit toward PSLF and IDR forgiveness, most borrowers need to enroll in an IDR plan by July 1, 2024. The ICR and PAYE plans are being phased out for many loan types in July, so if you intend to repay in one of those plans, apply now.

IDR plans base your monthly payment on your income and family size. The U.S. Dept. of Education recently implemented a new, lower-cost IDR plan called SAVE.

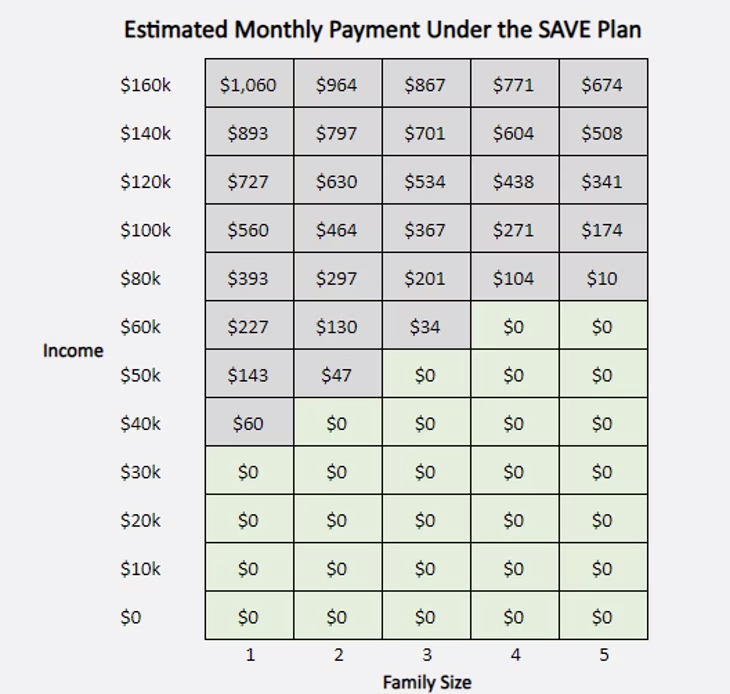

The new SAVE plan is the most affordable IDR plan in history! It cuts your monthly payments to $0 if you make less than $32,801 individually. It also caps interest so that your balance won’t grow.

Below is a chart you can use to estimate your SAVE payments. If you are married and file your taxes jointly, remember to include your spouse’s income. More detailed instructions for using this chart to calculate your SAVE payments are on this page from the Massachusetts Attorney General.

Enroll in SAVE or another IDR plan on the U.S. Dept. of Education’s website.

Are Parent PLUS Loans Eligible for SAVE or other IDR Plans?

Parent PLUS loans aren’t eligible for the new more affordable SAVE Plan or any other IDR plan. However, if they are consolidated, Parent PLUS Loans can become eligible for the Income-Contingent Repayment (ICR) plan.

Additionally, if you have (1) at least one Parent PLUS Loan and one other federal loan (of any type, including another Parent PLUS Loan), or (2) a FFEL Consolidation Loan that paid off one or more Parent PLUS loans, you can use a “double consolidation loophole” to get access to the new more affordable SAVE plan.

You must complete all the necessary consolidations by July 1, 2025 to access SAVE. Applying for all the consolidations before June 30, 2024 may help maximize the payment count adjustment.

Learn more about the double consolidation loophole on the Massachusetts Attorney General’s website.

Step 4: If You Work for the Government or a Nonprofit, Certify Your Public Service Employment.

The U.S. Dept. of Education can’t give you credit for your public service if it doesn’t know about it! Make sure you have employment certifications on file with MOHELA, the PSLF servicer, for all your qualifying employment periods since Oct. 1, 2007. If any periods are uncertified, work with your employer to fill out a PSLF Form, and submit it to MOHELA.

Learn more about what employment qualifies for PSLF on the U.S. Dept. of Education’s webpage.

Learn about how the Payment Count Adjustment is especially important for public service workers by watching this Webinar from the Massachusetts Attorney General.

And Always: Remember not to pay anyone to help you consolidate your student loans or otherwise seek debt relief. All these programs are free for qualified borrowers.